A story of student loan forgiveness for over two decades

An email from Kurt and his wife Lizzy: “It’s going to come back to haunt me” after NPR revelations

The debt cancellation was a result of an account adjustment promised by the Education Department after an NPR investigation uncovered mismanagement and mistakes in income-driven repayment plans. The adjustment gave borrowers credit for that time toward IDR’s promise of loan forgiveness. It was enough for over 804,000 borrowers to be eligible for debt cancellation.

After Kurt hangs up, his wife, Lizzy, grabs a bottle of bubbly from the fridge and they toast the email that says Kurt’s loans will come back to haunt him.

The email was from the Education Department, and it said that under that big IDR do-over, Kurt now qualifies to have his remaining $18,000 in loans forgiven — 20 years since his first payment.

Kurt said he couldn’t go back to sleep quickly since she was lying on his chest. I checked my email and saw the subject and I thought, “Oh my gosh, this is it!”

In the middle of November, Kurt woke up early with Pauline, who had a cold. He laid down on the couch with her, hoping she would fall asleep.

Biden’s Big Loan Repayment Plan was an Engine of Good, and at the Least Interest Rate: Kurt Panton and his Grandparents

“I am so close!” he laughed back. “When you were scrolling down on the spreadsheet, I was like, ‘Please get to 240, please.’ And then I saw 233 and I was like, ‘Nooo!'”

We were on Zoom in August. I showed them the spreadsheet I created and they sat on his lap with about a 10 months old girl on his lap.

When we first met, last December, Kurt told me he had been repaying his loans consistently since late 2003, and he knew that if President Biden’s big plan to erase hundreds of billions of dollars in federal student loans could survive a barrage of legal challenges, it would erase every penny of his remaining debts. (Pell Grant recipients like Kurt would have qualified for $20,000 in debt cancellation.)

Kurt Panton had been paying back his loans for 19 years when we met. He could get loan forgiveness in one more year if he did a do-over. Technically. The US Department of Education was still completely focused on the fate of the larger debt relief plan, even though they didn’t quite understand how or when the do-over would happen.

The Biden administration made a promise afterNPR’s investigation that they would review the payment histories of millions of borrowers and give them retroactive credit towards the promise of loan forgiveness.

On top of that, the advocates were warning of millions of people who could have benefited from the repayment plans, but were not told or put into forbearance.

The plan makes it possible for borrowers with loan debts of less than $12k to have multiple windows for loan forgiveness, starting after just 10 years for borrowers with $120,000 or less in loan debts, and which will result in borrower paying far less on SAVE than they would have on old plans. In fact, the department itself acknowledges that, under a previous plan for low-income borrowers, borrowers repaid, on average, $10,956 for every $10,000 they borrowed. They will pay back just $6, 121 under SAVE.

The plans were intended to help lower income borrowers by pegging their monthly payments to their income. They were meant to keep borrowers out of default and be an engine of good.

But I was thinking of complicated formulas, because Kurt and I both knew Biden’s grand plan for debt relief was no sure thing. I wondered if Kurt’s loans could qualify for debt relief, which would not have to survive the courts.

Kurt Panton: From Loans to Copywriting, or How a Dad Met Barefoot Could Get Heavier Than He Ever Wanted

“That’s going to make an immediate effect,” he told me back then, “and I don’t have to sit here and think about whether I qualify under all these complicated formulas.”

Kurt told me in a later year that he had been loyal to his payments. “I can’t even explain the outrage I feel when I look at comments on social media [about debt relief], and it’s like, ‘Well, you took out loans, you repay them!’ This has been a large financial debt to me. I do all I can to pay it back.

Kurt Panton is 43. He was raised in Miami with his mother and brother. After graduating from college in 2003, Kurt taught high school until 2016, when he moved to Germany, married Lizzy, who is German, and tried his hand at copywriting.

Kurt Panton’s laugh, surprising and unguarded, erupts when you expect it — after his baby daughter, Pauline, babbles adorably. He confessed to being frustrated with the federal student loan system.

The Education Department is Running Out of Funding to Cover the Costs of Student Loans: The Case of the Biden-Biden Reform of FAFSA

The question for 2024 is whether that will change, and whether the department can muster the people, time and money required to turn its many high-stakes promises (from SAVE to Fresh Start to FAFSA) into functioning, concrete programs.

As the Education Department told NPR in a recent statement, “We simply have not received the resources to implement this split as soon as we would have wanted.”

Congress passed and President Biden signed into law this bill that allows for former spouses to separate loans they consolidated while married. The move was a big win for women who were left with student loan debts when they left abusive relationships. The law achieved the impossible by squeezing through Congress’ partisan eye of the needle but it has been stuck in a queue of big ideas the education department cannot implement with enough staff and money.

Case in point: Congress charged the department with overhauling the Free Application for Federal Student Aid. The form is usually released in October, in time for students to understand their federal financial aid options before getting acceptance letters from colleges. But this new, overhauled FAFSA has been delayed until December. That’s bad news for families. What’s more, in the rush to finish the redesign, a mistake has been made that could mean many students and their families qualify for less federal student aid.

Talk of funding and finger-pointing aside, it’s worth noting that the fight for broad debt relief (and now the negotiated rulemaking) cost the Education Department considerable time, energy and political capital – resources that could not then be spent smoothing the return to repayment.

The department recently announced that of the 22 million borrowers with bills in October, 60% have made a payment by mid-November. These numbers could have been a lot worse, so the administration sources think they’re a win. More than 8 million borrowers failed to make a payments on time, and the organization is running out of money.

Some in the Biden administration complain that servicers are making a mess of the changes and hurting borrowers. But sources with the servicers, as well as a few within the administration itself, complain the Education Department is asking them to do the impossible, launching servicers from a catapult and telling them to build an airplane in mid-air, then shaming them when they fall.

The crisis has arrived a year later. If congress doesn’t agree to a funding solution soon, the Office of Federal Student Aid may have to tell loan servicers to reduce support for borrowers.

What is it about it that makes it all so special? As a correspondent who’s spent years covering the federal student loan system, my editors asked me to reflect on the year and share a few thoughts. I have three.

I began the year, back in January, with a story meant to sound an alarm: The federal agency overseeing the return to repayment, and responsible for implementing these seismic changes in policy, was facing the prospect of having to do it all with no extra funding.

These are seismic changes to the system. They are meant to make for a gentle repayment system, but they don’t mean immediate loan forgiveness.

SAVE is not the only change the Biden administration has rolled out. Fresh Start is a program that will help 7 million student loan borrowers who are in the process of default. For many people, Fresh Start makes it easy to improve their credit and the SAVE repayment plan is a great alternative to wage garnishment and forced collections.

I was working with Kenny Malone from Planet Money to dive into SAVE and find out what it meant for borrowers in the long run. You can listen to it here.

Source: Student loan forgiveness isn’t dead yet, and other takeaways from 2023

Student Loan Forgiveness: The Last Days of Student Loan Relief in the U.S. and the Story of Their 2023 End. The Case of Virginia Foxx

” America’s student loan system is broken, and this reckless, inflationary, and illegal expansion of executive authority will make it doomed beyond repair,” said Virginia Foxx, the Republican chair of the House Education Committee.

The plan exempts more of a borrower’s income from the monthly payment math than previous plans, and, under SAVE, interest no longer accumulates beyond what a borrower can afford to pay each month. The interest on low or $0 payments exploded as a result of previous plans. With SAVE, that stops.

It didn’t. Not completely. “Student loan forgiveness” is an overused word that has come to mean everything and nothing at all.

For example: On July 14, an otherwise quiet, summer Friday two weeks after the Supreme Court declared Biden’s plan unconstitutional, the Biden administration announced it was nevertheless erasing $39 billion of debt for 804,000 borrowers.

This is a long, muddy process, and whatever debt relief emerges from it, likely in 2024, will feel smaller than Biden’s first, expansive proposal. But something will likely survive, at least until it faces a fresh round of conservative legal challenges.

He was and he wasn’t. The U.S. Education Department is now working slowly, using a different law (the Higher Education Act) and a bureaucratic process known as negotiated rulemaking, to explore what kind of legal authority the education secretary does have to cancel student debts.

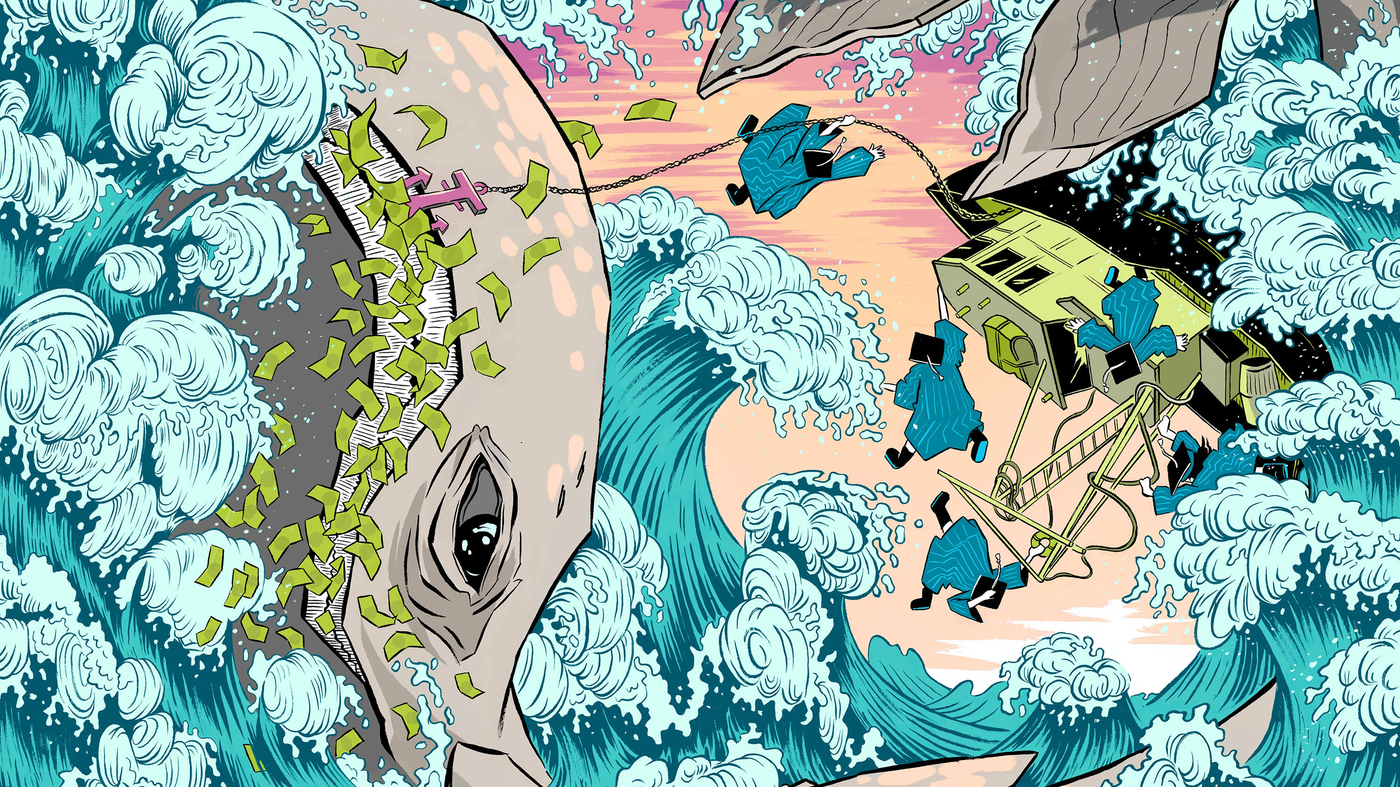

If the story of their 2023 could be written by the ghost of Herman Melville, he’d have plunged borrowers into the frigid depths, bound to a white whale big enough to embody the disappointment of millions of Americans who spent the first half of the year hoping to be free of their student loans, and the second half realizing they and their debts were still intertwined.

It was a year for the ages. A year that will be studied for many decades, as the most important event of the past year, a halt in payments due to the U.S. Supreme Court’s scuttling of President Biden’s debt relief promises.

Many, perhaps most borrowers will tell you that 2023 was the year the idea of “student loan forgiveness” died atop the mahogany bench of the Supreme Court.